LED Lighting Programs and Government Incentives for Energy-Efficient Lighting in 2025

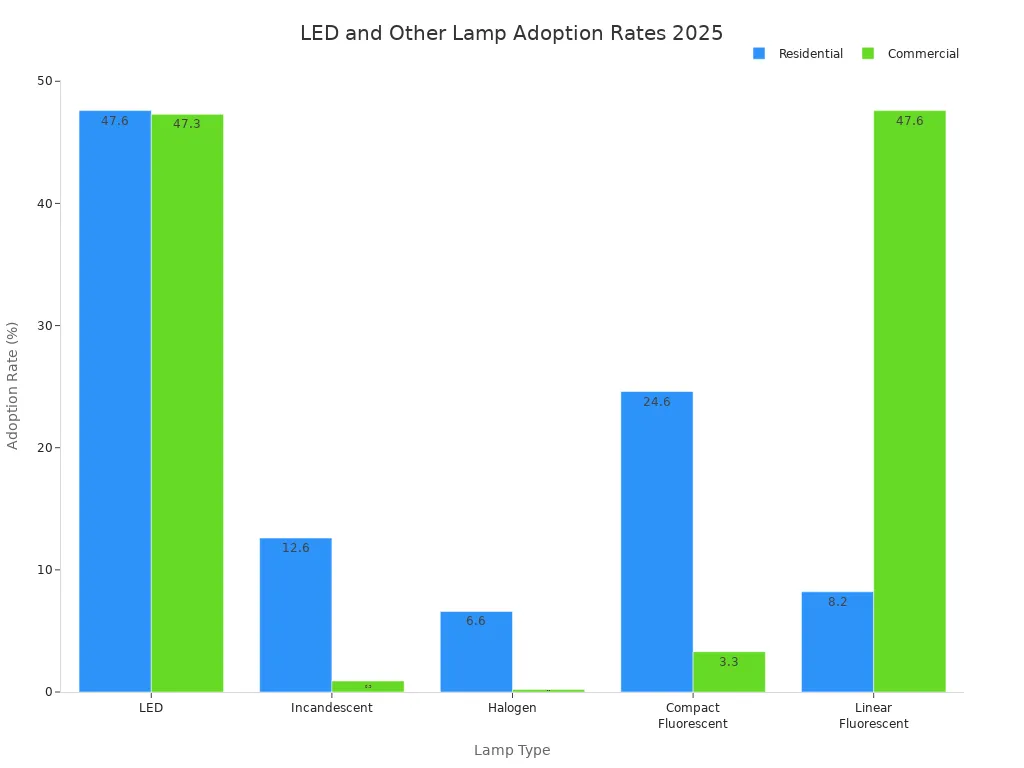

LED Lighting Programs in 2025 help people save more money. Rebates are bigger now. New federal tax credits give rewards for saving energy. Homeowners and businesses both get these benefits. In homes, 47.6% use LED lights. Commercial places have about the same rate. This change helps lower bills. It also cuts down on wasted energy. The chart below shows how many use LED lights in homes and businesses:

Switching to a Led Light product can change how much energy you use. Many utility company About Us pages talk about these programs now.

Key Takeaways

Federal, state, and utility programs give rebates and tax credits. These help homeowners and businesses save money. You can get these by switching to energy-efficient LED lighting in 2025.

Many programs need you to use certified LED products. You must follow certain rules. This includes filling out paperwork and meeting deadlines. You need to do these things to get incentives.

Savings are different in each region. You can combine several incentives. This is called stacking. Stacking can pay for much of the upgrade costs. It also helps you save more money.

Smart lighting controls can help save more energy. Examples are motion sensors and daylight dimmers. These can help you get bigger rebates.

To get the most benefits, apply early. Use approved vendors and meet efficiency standards. Get all your documents ready before you start your project.

LED Lighting Programs in 2025

Federal Incentives

Federal incentives in 2025 make LED Lighting Programs better for homeowners and businesses. The government has programs to help people save money and energy. These include the Home Efficiency Rebate and the Energy Efficient Home Improvement Credit. They give rebates and tax credits for energy-saving upgrades like LED lighting. To get these, homeowners must upgrade their main homes with LED products that meet Department of Energy rules, such as DLC or ENERGY STAR. Some programs need approval before you install anything and ask for paperwork, like energy checks and tax forms.

Businesses can get bigger tax deductions for LED upgrades. The Section 179D deduction helps owners of commercial buildings who put in energy-saving lights. The deduction amount depends on the building’s size and how much energy it saves. The table below shows possible deduction amounts for 2025:

Year | Base Deduction (per sq ft) | Max Deduction with Prevailing Wage & Apprenticeship (per sq ft) |

|---|---|---|

2025 | $0.58 to $1.16 | About $2.90 to $5.81 |

A building must cut energy costs by at least 25% to get the deduction. The biggest deduction is for projects that meet wage and apprenticeship rules. These incentives help more people join LED Lighting Programs and lower their bills.

State & Local Programs

State and local governments also help LED Lighting Programs with their own incentives. Some states give big rebates, while others use strict energy rules. The table below compares different regions:

Region/State Group | Incentive Type | Key Features and Differences |

|---|---|---|

Northeast (NY, MA, PA) | Big rebate programs | Large savings for businesses; detailed application steps |

Midwest & Northwest (IL, MI, WA) | Simple rebate programs | Easy approval; many choices; easier for businesses |

California | Energy rules (Title 20, Title 24) | Focus on tough energy codes; no direct rebates |

Texas | Good rebates | Hard and slow application process; may stop small businesses |

Florida | Few rebate chances | Not many rebate funds; less good for businesses wanting to save money |

Some states, like New York, are changing their plans. By the end of 2025, New York will stop LED lighting rebates and use strict energy rules instead. Homes over 25,000 square feet must upgrade lights in shared spaces, like lobbies and halls. At least 75% of lights must meet high-efficacy standards. Owners must send a report and finish upgrades by the 2025 deadline. After that, they must report energy and water use every year. These changes show how LED Lighting Programs keep changing at the state and local level.

Utility Rebates

Utility companies are important for LED Lighting Programs. Many give rebates to help customers switch to energy-saving lights. Programs from ComEd and NIPSCO help lower the cost of LED upgrades. In 2025, NIPSCO gives rebates for equipment bought and installed that year. These rebates go to people who apply first. But bonus incentives, like the 20% bonus from past years, are not offered now.

Rebate amounts change by utility and product type. For example, LED tubes may get about $4 each, while parking garage lights can get up to $94 each. Customers should check their utility’s website or the DSIRE database for current rebates and program rules. Utility rebates, plus federal and state incentives, make LED Lighting Programs a smart way to save money and energy.

Eligibility & Application

Who Qualifies

Who can join LED Lighting Programs in 2025 depends on where you live and who you are. Many programs help businesses, apartment buildings, and community groups. Some utility programs also help churches and veterans’ groups. Homeowners do not always get to join, especially if the program has ended. For example, Con Edison stopped its lighting program at the end of 2024. Now, people in that area must pay for upgrades themselves, even if the law says they need LED lighting. Most programs say you must put approved LED products, like lamps or fixtures, in your building.

How to Apply

To get rebates or tax credits, you must follow some steps. First, look up LED Lighting Programs from your state or utility company. Make sure your products meet rules like ENERGY STAR or Design Lights Consortium. Many programs want you to use certified contractors with the right insurance. You need to collect all your paperwork before you start. Some programs want you to get approval before you install anything. Deadlines are important, so do not miss them or you might not get the rebate. For LED to LED retrofits, you often need to use less power—usually 3 to 5 watts less per lamp or at least 25% less. You also need more light for each watt. For example, Connexus Energy wants you to use 25% less power and have better efficiency for upgrades.

Required Documentation

You must give detailed paperwork to get incentives. You usually need:

Details about the LED fixtures

Records and photos of the installation

Energy audit results if they ask for them

Proof your products meet ENERGY STAR or DLC rules

Tip: If you forget paperwork, your application might get rejected. Always check that you have all forms, receipts, and product details before you send them in.

You should turn in your paperwork before the deadline. If you have questions, ask the rebate provider or utility company so you do not make mistakes.

Savings & Rebates

Average Savings

LED Lighting Programs in 2025 help people save money. Most homes can save about $225 each year. This is from lower energy bills. The number comes from Energy.gov. It shows how much energy-efficient bulbs help. Many programs give rebates for LED lights. Rebates can pay for up to 70% of materials. Some rebates give $3 for every bulb you change. Businesses can save even more money. They save a lot when they upgrade big spaces. These savings come from using less electricity. People also get money back from rebates and tax credits.

💡 Tip: Rebates and incentives help homes and businesses pay less at first. This makes it easier to switch to LED lighting. You can start saving money right away.

Regional Differences

Savings and rebates from LED Lighting Programs are different in each place. Some areas give bigger rebates or extra bonuses. Other places have strict rules or less money for rebates. The table below shows how rebates and savings change by region:

Region/State | Program Administrator | Rebate Amounts & Bonuses | Savings & Benefits | Notes on Changes in 2025 |

|---|---|---|---|---|

Pacific Northwest (Oregon) | Bonneville Power Administration (BPA); Local utilities like EWEB | Upfront cost reductions; EWEB offers 25% bonus on lighting rebates (ends Sept 1, 2025) | Energy savings up to 50% compared to traditional lighting | New incentive structures and online applications after Sept 2025 |

United States | Utilities, State Agencies | Up to 100% of lighting costs in some programs | Rebates vary by state; experts can help | Programs differ widely; check local rules |

Canada | Provincial Agencies | Up to $1,000 CAD per fixture | Incentives for smart, high-efficiency systems | Varies by province |

Many things make these differences happen:

Climate, like humidity and sunlight, can need stronger lights.

The ground and site can make installing lights harder.

Labor costs are not the same everywhere.

Local rules about energy and light pollution can raise costs.

Some places have more grants and subsidies. This makes incentives better.

Government rules matter a lot too. Some places, like Asia Pacific, give big subsidies. North America and Europe focus on new technology and saving energy. Cities with smart projects may give more incentives.

Stacking Incentives

People can use more than one incentive to save more money. This is called "stacking." You can use federal tax credits, state rebates, and utility programs together. For example, people in New York and New Jersey can use a federal tax credit (up to $3,200), state rebates (up to $12,000 in NY, $4,000 in NJ), and utility incentives. Stacking these can save a lot on lighting upgrades. The last day to use these together is December 31, 2025. It is important to act soon.

Incentive Type | Description | Typical Savings / Rebates |

|---|---|---|

Prescriptive Rebates | Fixed dollar amounts per fixture for approved LEDs | $25 - $150 per fixture |

Custom Rebates | Based on actual kWh savings | $0.05 - $0.25 per annual kWh saved |

New Construction / Renovation | Incentives for exceeding code efficiency | 50% - 75% of incremental costs |

Federal Tax Deductions (Section 179D) | Tax deductions for qualifying projects | $0.50 - $1.00 per square foot |

Here is a real example of stacking. An auto parts company spent $340,000 on new lights. They got $153,000 in incentives. This paid for about 45% of the project. They used prescriptive rebates, custom demand reduction, a state grant, and a federal tax deduction.

"If a prescriptive rebate is offered for a lighting project, customers must use that program. Most programs do not let customers pick a custom rebate just because it pays more." – Leendert Jan Enthoven, President, BriteSwitch

Utility and government incentives can pay for 20% to 50% of starting costs. New construction programs may pay up to 75% of extra costs for high-efficiency lighting. By using all the incentives, homes and businesses can make LED Lighting Programs save even more money.

Trends & Tips for 2025

New Rules

There are many new changes for lighting incentives in 2025. States have stopped letting people use fluorescent tubes. This means more people want LED tubes. Rebates for LED tubes are higher for a short time. Some states, like Massachusetts and Oregon, will soon stop giving rebates for basic LED retrofits. Now, programs want people to use smart lighting, like occupancy sensors and networked controls. Utilities let people apply for rebates online now. This makes things faster but can be harder to understand. More people are applying, and there is less money, so it is harder to get rebates. New York and California have tougher energy codes. Some states say commercial buildings must upgrade lights by certain dates.

Programs give more rewards for advanced lighting controls than for basic LED upgrades.

Some rebates for regular LED tubes will stop by the end of 2025.

Most rebate applications are now done online.

Stricter building codes mean you need better lighting.

⚠️ Note: Rebates for basic LED retrofits might go away soon. Try to get them before they end.

Smart Lighting

Smart lighting has gotten much better. New LEDs use less energy and last longer. Many systems have sensors that turn lights on or off when someone enters or leaves. Some lights get brighter or dimmer when there is more or less sunlight. Smart controls can work with apps or building systems. These features help save more energy and can get you bigger rebates. For example, some utilities give $3–$5 for each lamp if you use less power. Businesses can use tools like RebatePro to find good programs.

Smart lighting also has:

Tunable white light to help people feel comfortable and focus.

Motion sensors and ways to use sunlight for lighting.

Schedules that run by themselves and remote controls.

Ways to connect with building management systems.

💡 Tip: Using smart lighting controls can help you get bigger rebates and lower your energy bills.

Maximizing Benefits

People can get the most savings from rebates and tax credits by doing a few things:

Look up rebate programs early so you do not miss deadlines.

Use approved vendors or trade allies, since 17% of programs need them.

Pick lighting controls, like occupancy or daylight sensors, to get higher rebates.

Use federal, state, and utility incentives together to save more.

Apply online to get approval and payment faster.

Make sure all products meet efficiency standards like ENERGY STAR or DLC.

Get all your paperwork ready before you start your project.

A table can help you remember these tips:

Step | Why It Matters |

|---|---|

Use approved vendors | Makes sure you can get the rebate |

Add smart controls | Lets you get higher rebates |

Meet efficiency standards | Needed for most incentives |

Apply early | Helps you get rebates before money runs out |

✅ Tip: Projects with smart controls and new standards usually get the best rebates.

LED Lighting Programs in 2025 give bigger rebates than before. LED products last longer and help the environment more. Using more LEDs could lower world carbon emissions a lot by 2030. Homes and businesses save money on energy and repairs when they switch to LEDs. People should act fast to get better tax credits and rebates. To get the most benefits, they should learn about incentives, pick certified products, and ask experts for help.

FAQ

What types of LED products qualify for rebates in 2025?

Most programs want ENERGY STAR or DLC-certified LED bulbs, tubes, and fixtures. Some programs also let you use smart lighting controls. Always look at the program’s approved product list before you buy anything.

How long does it take to receive a rebate or tax credit?

Processing times are different for each program. Many utility rebates come in about 6 to 12 weeks after you get approved. Federal tax credits are used when you file taxes for the year you made the upgrade.

Can homeowners and businesses combine multiple incentives?

Yes, they can. People can use federal tax credits, state rebates, and utility incentives together. This way, they can save the most money on lighting projects.

What happens if a program ends before I apply?

If a program ends, you cannot send in a new application. People should check the deadlines and apply as soon as they can. Some places might have new programs later, but the benefits could be different.

See Also

Advantages Of LED Street Bulbs In Energy And Installation

Exploring LED Indoor Lighting Types And Energy Efficient Uses

Comparing LED Streetlights And Traditional Lights For Savings

Modern LED Highway Lighting For Safety And Energy Efficiency

Effective Commercial Lighting Solutions And Best Business Practices